Responsible Boards

Skill Matrix Board Skills and Composition

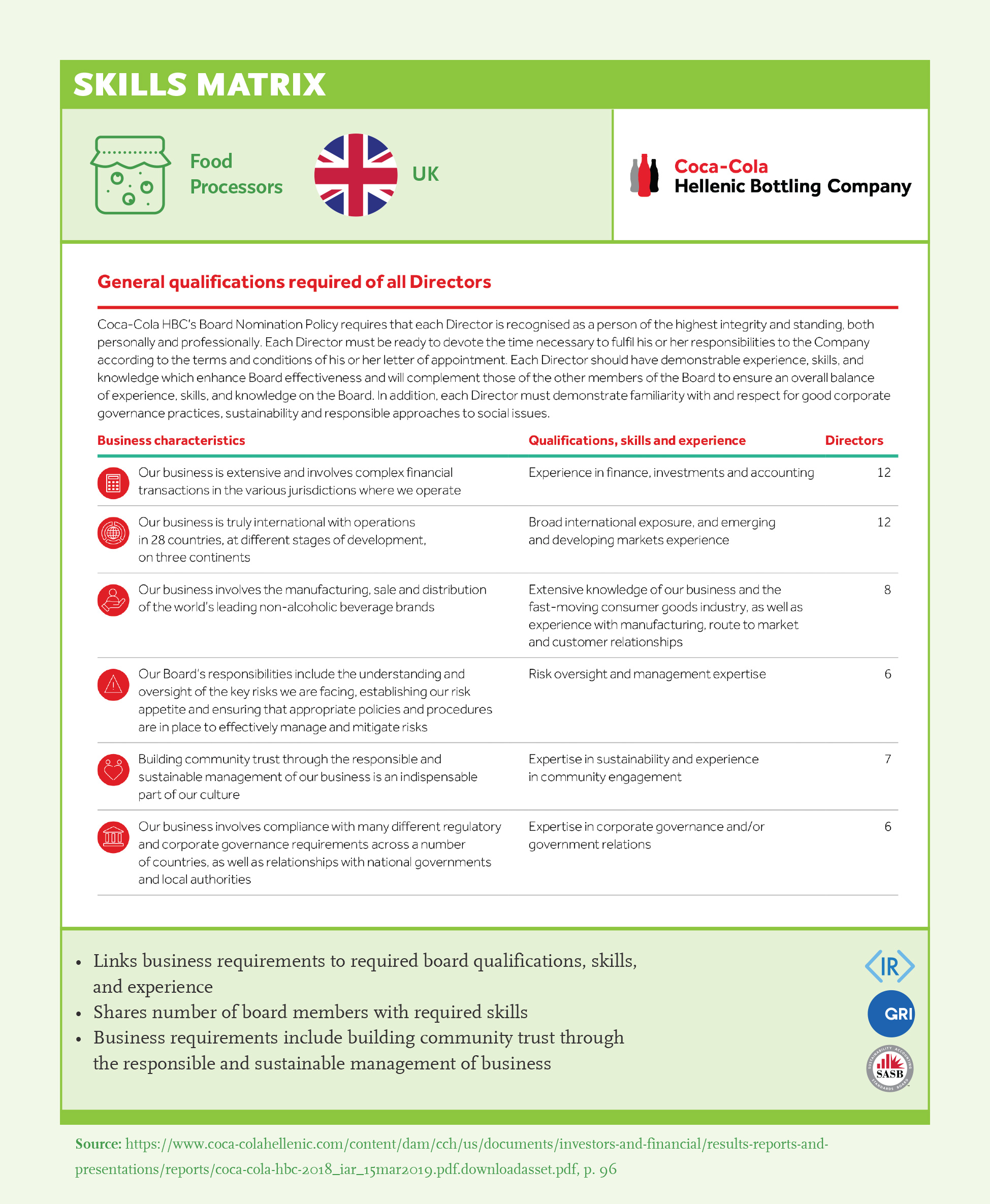

Board members need to have the right skills to provide guidance and oversight to the sustainability plans of the corporation. The Board needs to have sufficient expertise to understand the decision-making processes of key stakeholders, have members who are familiar with evolving sustainability standards and practices, and sufficient diversity to adequately evaluate different dimensions, perspectives, and risks of sustainability issues.

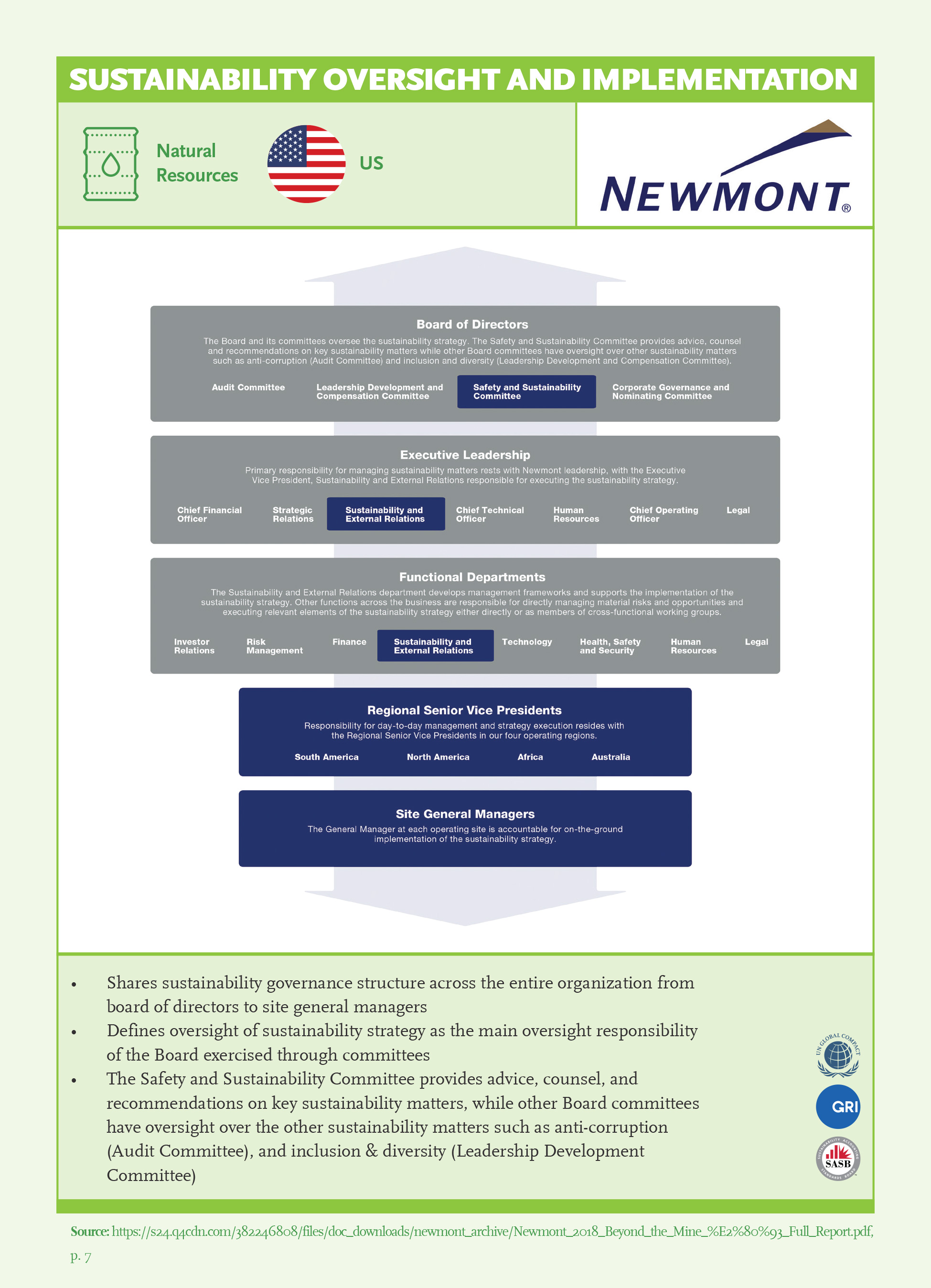

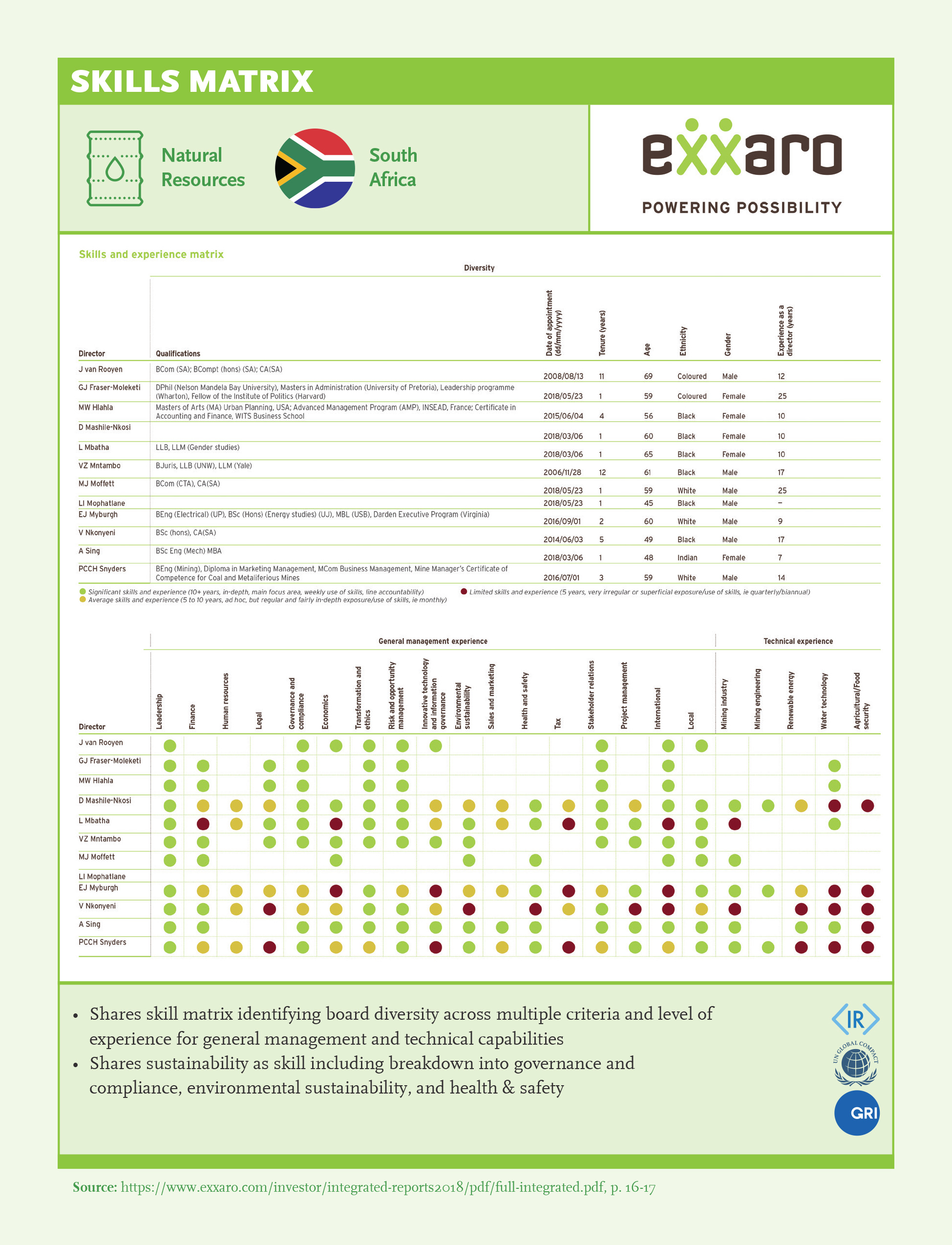

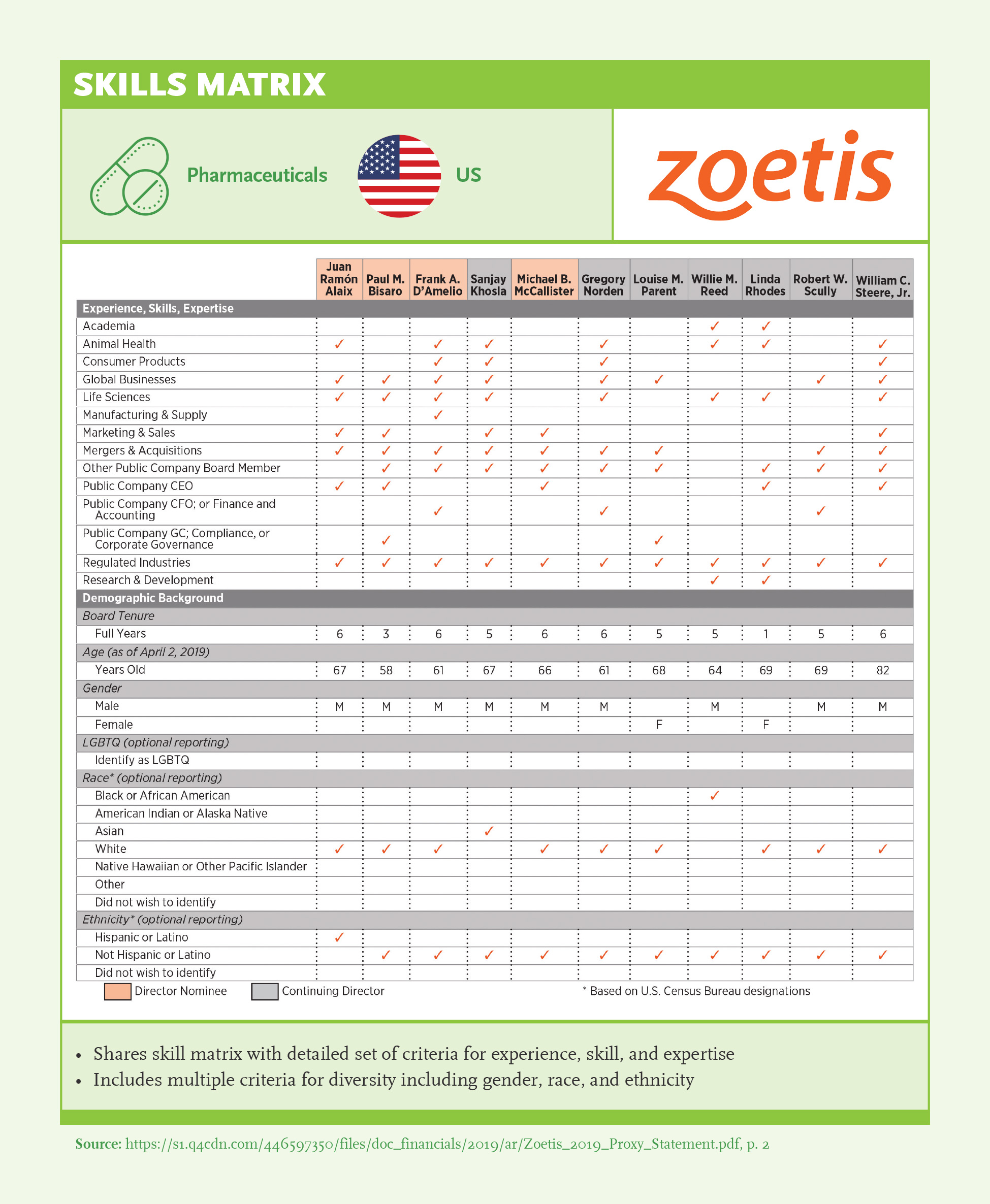

A skills matrix identifies the skills, knowledge, experience, and capabilities desired of a board to enable it to meet both its current and future challenges and realize its opportunities. Disclosing a skills matrix is good governance and offers an opportunity for considered reflection on whether the board has the right skills and diversity for providing guidance and oversight on sustainability.

Recommendations

- 1Link business requirements to board qualifications and make sustainability a board priority: Responsible boards make sustainability a leadership priority and ensure they have the right people (skills and diversity) to provide leadership and direction on sustainability. (Ex: Coca-Cola HBC)

- 2Publish a skills matrix: A skills matrix identifies the skills, knowledge, experience, and capabilities desired of a board to enable it to meet both its current and future challenges and realize its opportunities. A comprehensive skills matrix should include business priorities, skill and experience of board members in table format, information to assess diversity, management experience, relevant industry and geographical experience as well as sustainability skills relevant for the companies’ priorities. (Ex: Exarro)

- 3Focus on sustainability as a board member skill: Sustainability-related skills requirements can cover a wide range of ESG issues, which are necessary for board members to understand the sustainability risks and impacts across the corporation’s value chain and how this might impact the business model and competitive positioning of the corporation. Boards also need to have the skills and experience to provide guidance on sustainability driven innovation and value creation opportunities.

- 4Increase diversity to manage sustainability: Managing sustainability is complex and requires multiple perspectives to be represented for the board to effectively engage in strategic discussions and make long-term business decisions. We find that best-in-class companies ensure that their boards are fit to drive change towards a sustainable business by having diverse boards and assess diversity across multiple dimensions including age, tenure, gender, ethnicity, cultural background; geographic, functional and industry experience. (Ex: Zoetis)

- 5Foster productive dialogue: Having the right skills, experience and diversity is the first step – but there must be productive dialogue within members of the board to reap the benefits of diversity. This requires experienced, collaborative, and responsible board members, and a strong board culture based on trust. Proper examination of diversity of mind would need a review of board proceedings to see if different alternatives and their potential impacts are evaluated and challenged with respect to risk and reward, short- term and long-term effects, and effects on different stakeholders.

Key Findings

A skills matrix A skills matrix identifies the skills, knowledge, experience, and capabilities desired of a board to enable it to meet both its current and future challenges and capture opportunities. Disclosing a skills matrix is good governance and offers an opportunity for considered reflection on whether the board has the right skills and diversity for providing guidance and oversight on sustainability.

Our research reveals that the assessment of functional skills and the use of skills matrices is still not widespread, even among leading companies – but there is promising increase:

- Companies that have at least one board member with sustainability as skill increased from 31% to 40%,

- Skills matrix increased from 21% to 36%, sustainability as skill in skill matrix is only 8%.

- Highest share of skills matrix in Natural Resources and Retail, lowest in Telecommunication and Automotive,

- >50% of companies in the US, UK and South Africa publish a skills matrix, while none of the companies in Germany and Türkiye do,

- Half of the companies that have Integrated Reporting publish a skills matrix.

Best Practice Examples

Executive Compensation

In order to focus management behavior on capturing opportunities from sustainability and ensure that sustainability practices are adopted as everyday practice in decision making, Boards need to make management explicitly accountable for the company’s environmental and social impact. By aligning executive compensation with strategic sustainability targets and tying performance payouts to non-financial sustainability metrics, Boards can sharpen management’s focus on sustainability issues.

Recommendations

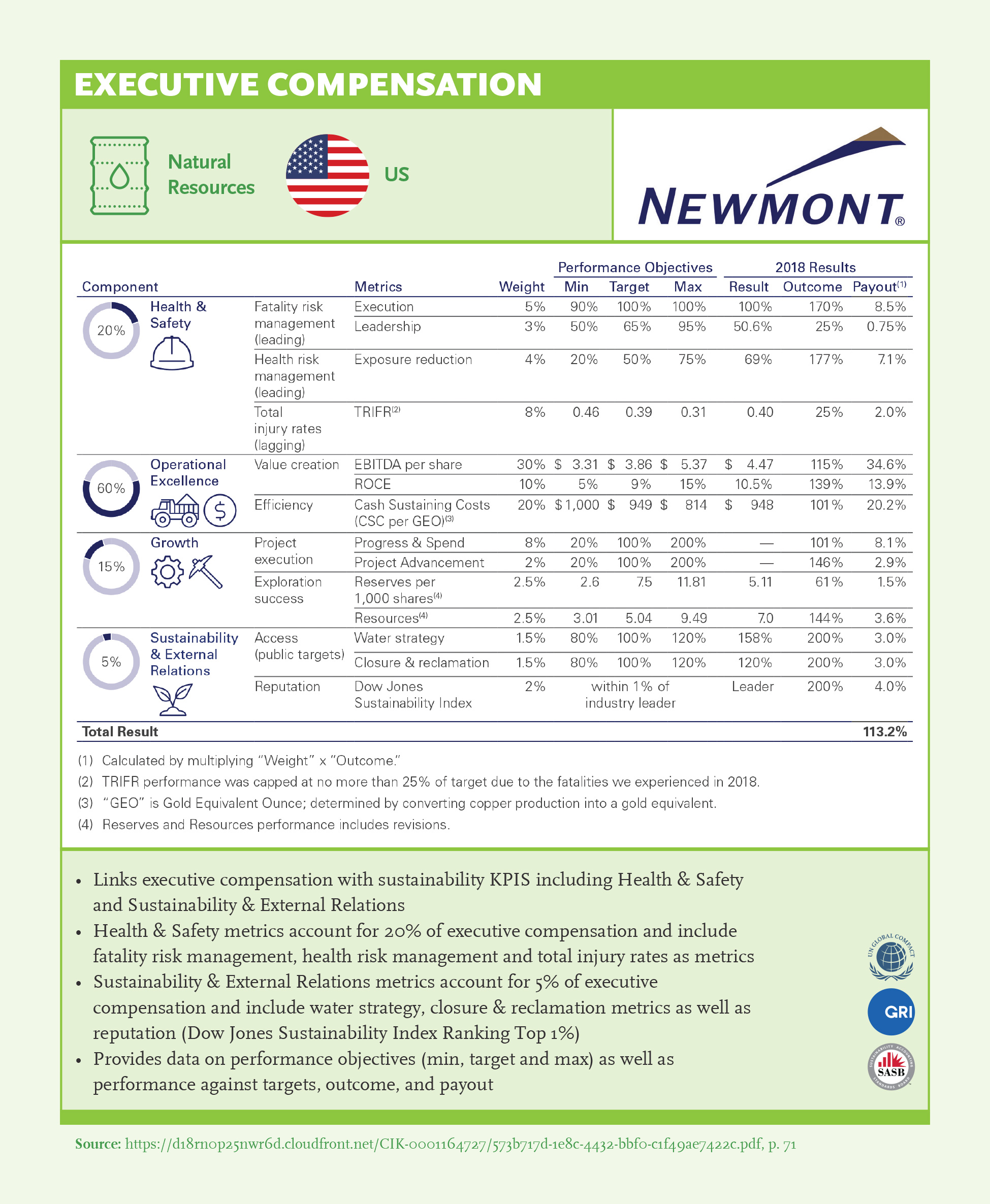

- 1Identify appropriate ESG metrics material to financial performance and aligned with long-term strategy: Metrics should be defined on issues most relevant and material to business. For example, CO2 emissions can be more material to companies in the coal industry, while health & safety for Mining and Construction, or workforce diversity in consumer goods. Best-practice examples demonstrate how the selected metrics are related to strategy and performance objectives. (Ex: Newmont Mining)

- 2Link Executive Compensation to material sustainability/ESG targets: To improve corporate accountability for sustainability and focus management attention, tie executive compensation to material ESG targets. (Ex: Anglogold Ashanti)

Best-in-class companies:- Select metrics that are forward looking, clear, available, replicable, comparable, time-bound,

- Make sure sustainability metrics are a meaningful component of the overall remuneration framework with appropriate time horizon in line with business strategy and challenging to incentivize outperformance,

- Set both short-term vs long-term targets: Sustainability targets require long-term planning as well as immediate action.

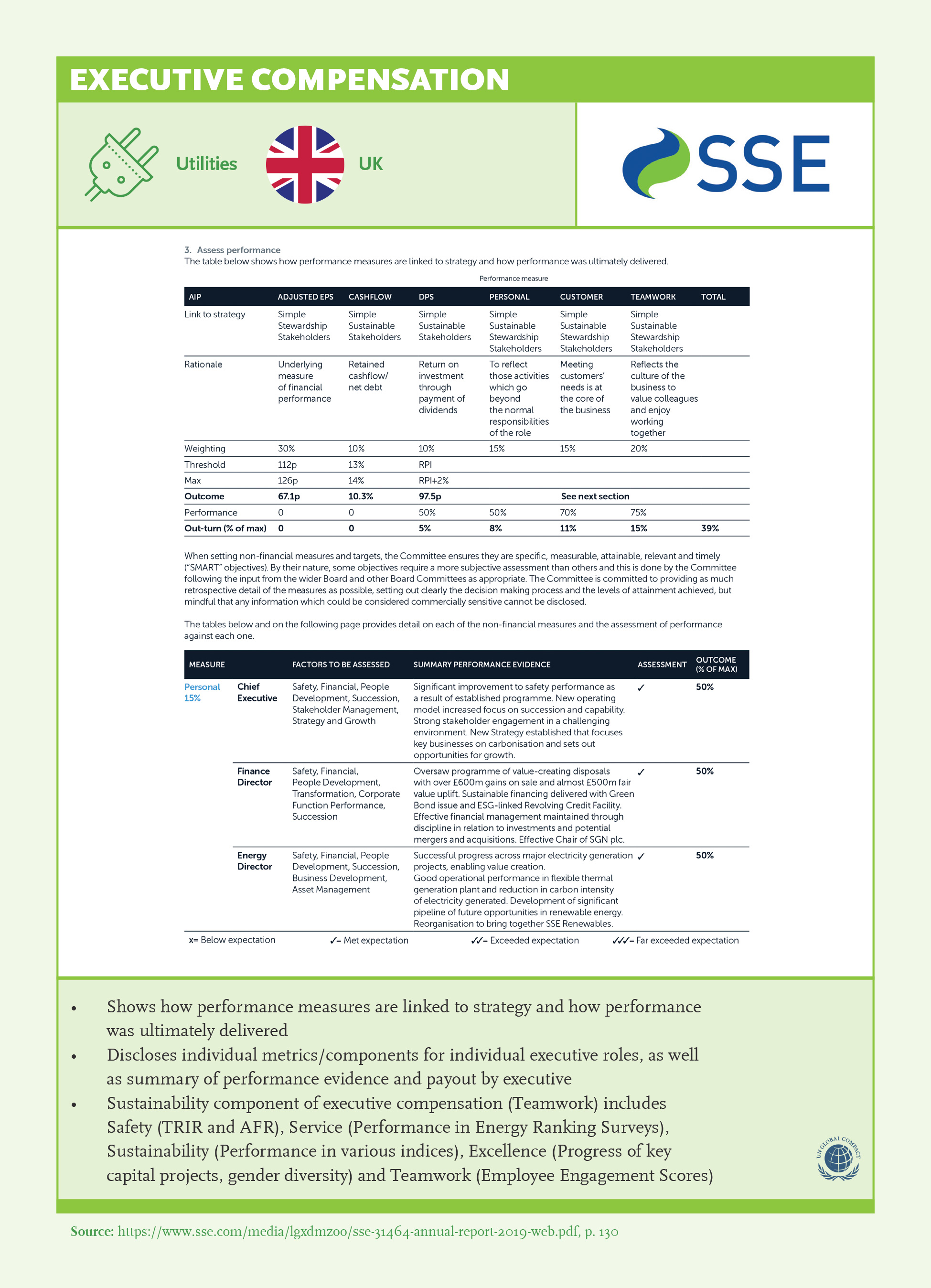

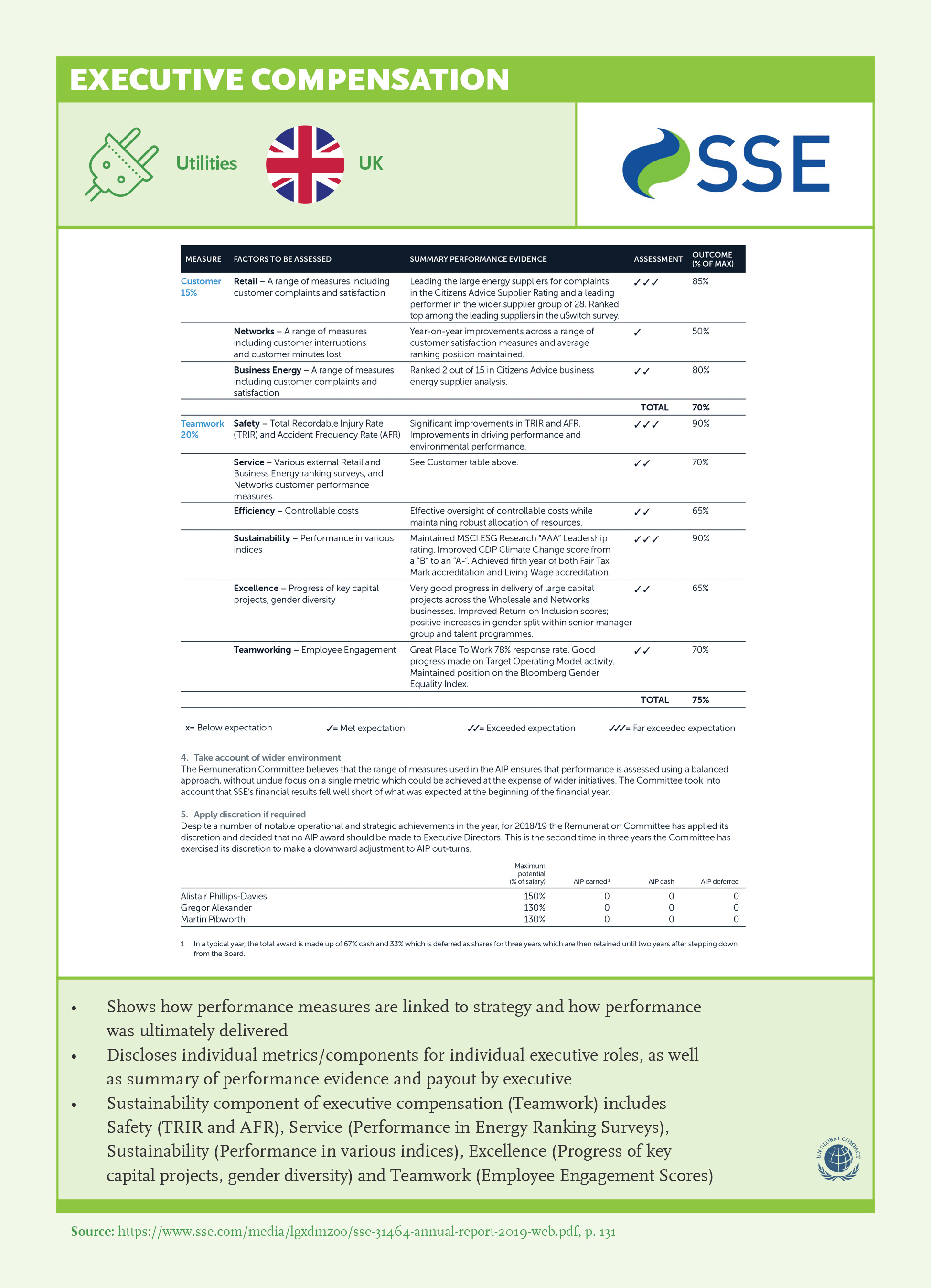

- 3Provide high-quality disclosure to signal commitment to sustainability: Best examples from GSL clearly disclose rationale with metrics in line with business strategy and allow sufficient information for investors to assess performance and payouts against ESG goals. Benchmarking with industry peers and disclosing executive compensation as a multiple of an average employee’s salary are examples of ways companies make this information useful for investors. (Ex: SSE)

- 4Integrate sustainability into the performance management systems of the entire organization: Linking executive compensation with sustainability metrics is the first step, to move the entire organization towards sustainable value creation, performance management systems must be aligned for the entire organization.

Key Findings

- All companies share executive compensation, 90% share link to financial targets, but only 28% share link to sustainability targets.

- Companies that share compensation linked to non-financial targets increased from 31% to 34% from SGS 2019 to SGS 2020 and link to sustainability KPIs increased from 23% to 28%.

- Companies focus more on social sustainability KPIs (28%), whereas only 12% link to environmental KPIs and 9% to governance KPIs.

- Within companies that share sustainability KPIs for Executive Compensation, we find that 28% share social KPIs, 12% share environmental KPIS and 8% share governance KPIs.

- Linking sustainability KPIs to Executive Compensation is highest for South Africa. In South Africa, we find that 31% link executive compensation with environmental KPIs, 69% link with social KPIs and 24% link with governance KPIs.

Examples of sustainability KPIs for Executive Compensation are shared below:

Board Guidance

The Board is responsible for setting the company’s direction and sets the tone at the top. Right guidance is required for companies to manage risk and capitalize on opportunities related to sustainability, as well as taking a leadership role in creating a more sustainable future. Boards should ensure that sustainability issues are integrated into the company’s strategy and reflected in its policies and practices. Responsible Boards provide guidance to ensure the comprehensiveness of scope for sustainability guidance by integrating ESG issues into the company’s value proposition, policies, and strategy.

Recommendations

- 1Board should provide guidance on sustainability and set the tone at the top: Board’s role is to ensure a systematic approach to sustainability governance is adopted by the organization. Companies should identify priority sustainability objectives and demonstrate commitment in material sustainability areas.

- 2Define commitments for sustainability through policy and cover all ESG relevant dimensions: The scope of sustainability issues that need to be covered should include a comprehensive set of subjects such as safety, health, environmental, and community impact; human rights, labor rights, anti-corruption and business ethics.

- Environmental policy can cover climate change, energy, waste & packaging, water, responsible sourcing, hazardous materials, and biodiversity. (Ex: General Mills)

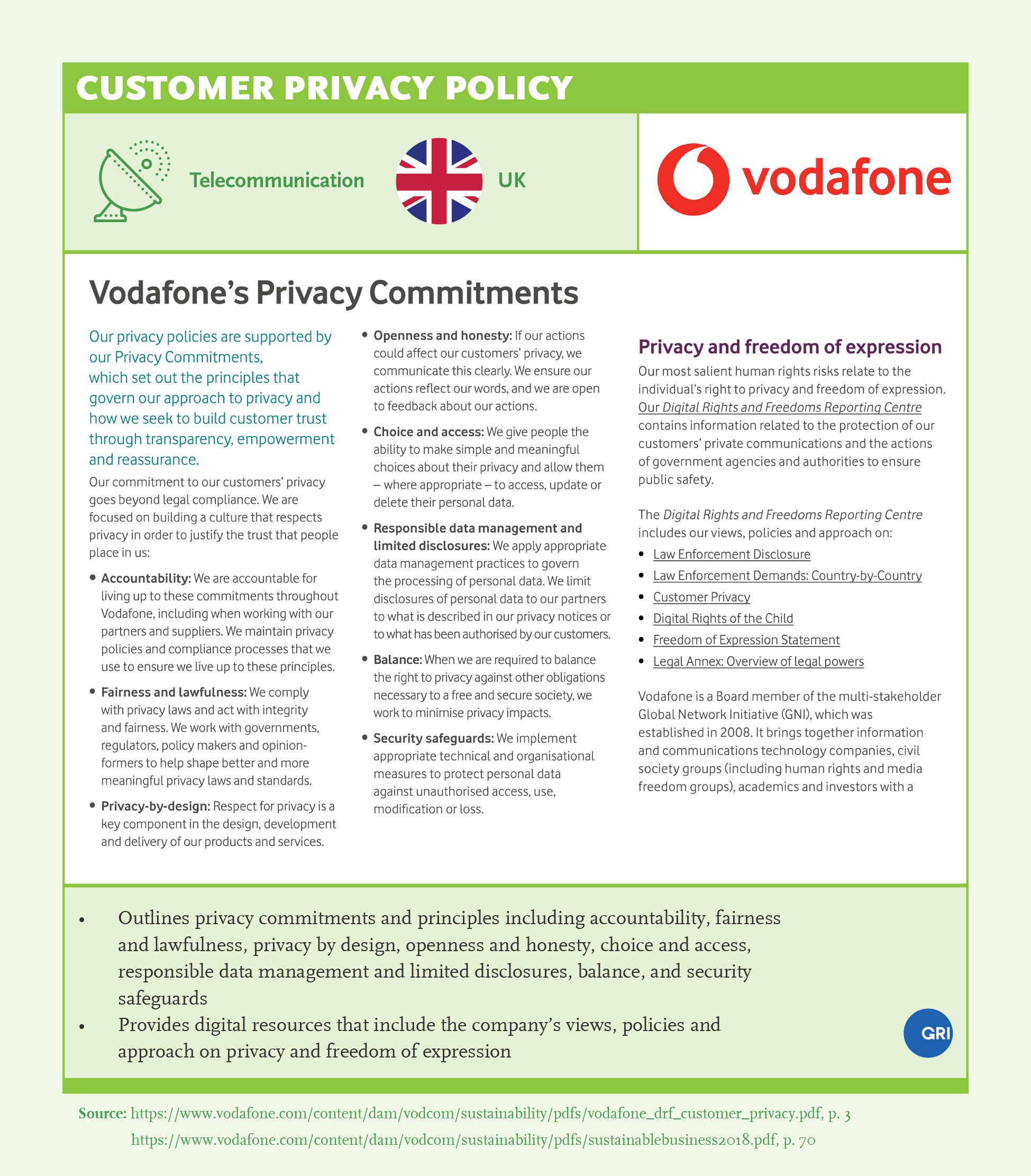

- Social policy can cover a wide range of issues including health & safety, human rights, non-discrimination, child labor, diversity inclusion, gender equality. (Ex: Vodafone)

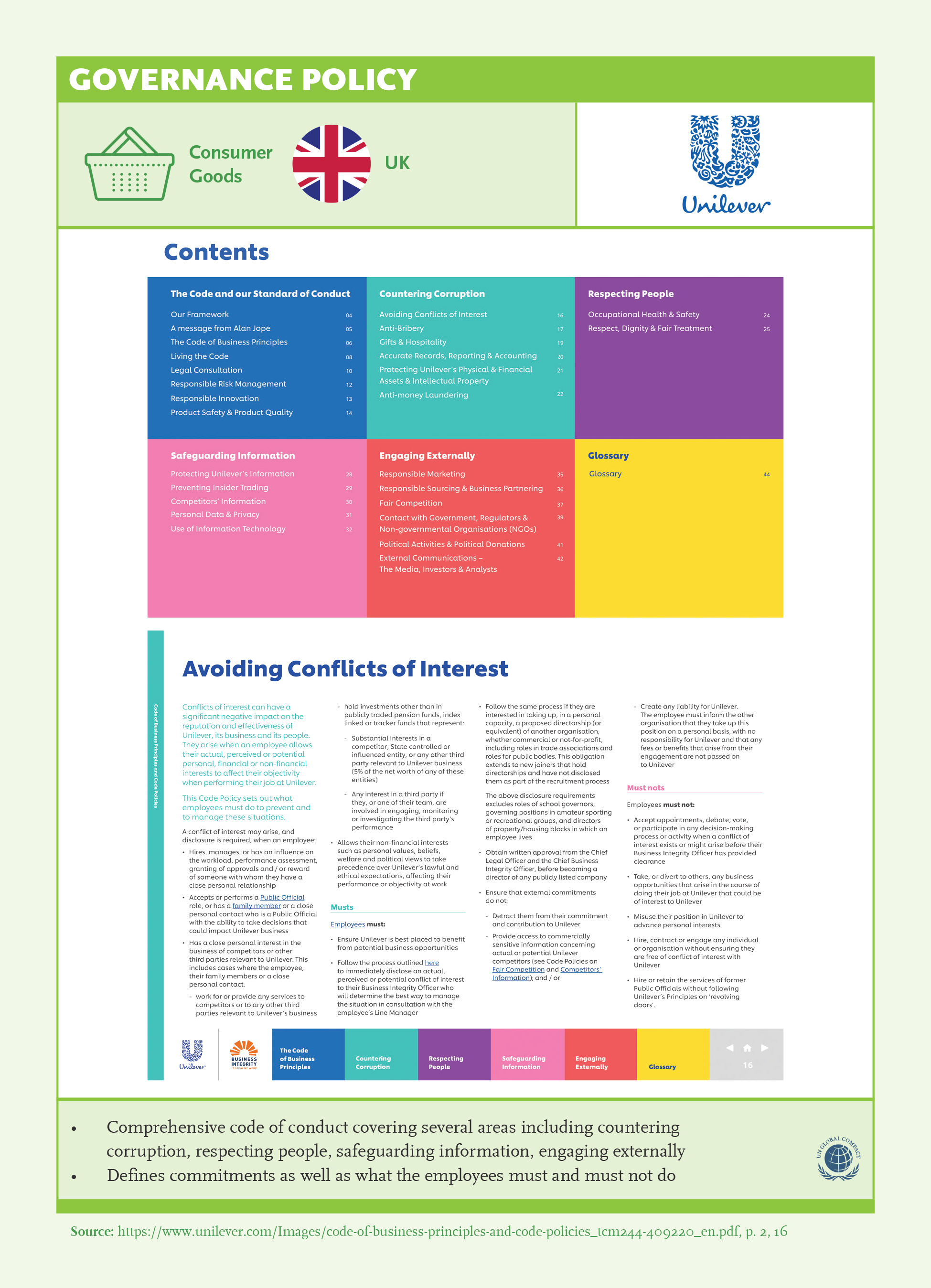

- Governance policy should cover executive compensation, anti- corruption, business ethics, risk management, supplier code of conduct, donations, related party transactions, board diversity, and succession planning. (Ex: Unilever)

- 3Ensure policy covers and is adopted by all relevant stakeholder groups including employees, supply chain and communities: Companies should ensure implementation of the policy in all levels of the organization and across the supply chain. Another key issue to consider is the standards of conduct and level of implementation in all the jurisdictions that the company operates in. OECD’s MNEs Guidelines particularly focus on this issue.

- 4Regularly review the policy: Compare and collaborate with sector standards and best-practice examples to keep the policy relevant to changing conditions.

Key Findings

To achieve sustainability goals requires establishing sustainability policies and practices to guide company and employee behavior on a range of issues material to the company’s ability to create value. Policies can cover a wide range of matters and would differ between companies. A list of the policies we looked for and the results are shown in the table below:

- Environmental Policy: >90% have climate change, energy, waste & packaging, and water policy. There is potential for improvement in developing policies on responsible sourcing, hazardous materials, and biodiversity.

- Social Policy: >90% of GSL policies cover human rights, labor practices, and customer/community related issues. There is room for improvement in customer privacy and stakeholder engagement policy and disclosure.

- Governance Policy: Governance policies of GSL cover executive compensation, anti-corruption, business ethics and risk management. Board diversity and succession planning are the lowest.

Policies should be substantiated through relevant KPIs, targets and measurement of results, which will be discussed in the next section on sustainability performance.

Best Practice Examples

Board Oversight

The board’s oversight role requires setting up an effective internal control mechanism, ensuring the independence of audit and strict compliance, monitoring ethics and business conduct within the company and its value chain, and transparency in external reporting and disclosure. Effective tracking of sustainability performance and communication to the board is essential for improving oversight of sustainability.

Board structures for sustainability governance should be defined at the Board level and can include direct Board Oversight or Sustainability Committee. There should also be management responsibility explicitly defined. To provide effective oversight, Boards should adopt an assurance framework that includes internal and external audit functions and timely reporting of key informational to the Board to assess sustainability risks and opportunities.

Recommendations

- 1Define the Board’s sustainability responsibilities: To provide oversight over material sustainability issues, boards should clearly define their sustainability responsibilities through a ‘Sustainability Charter.’ The Charter should clearly specify the scope of the board’s oversight of sustainability issues; specifically reference the company’s priority sustainability issues; make the linkages with the business strategies and priorities, and provide a framework for the integration with the company’s risk management systems. (Ex: Anglo American)

- 2Set up formal structures and ensure regular Board review of ESG issues: ESG review should be a Board priority and boards need to allocate sufficient time and resources to deal with the sustainability risks and management plans to address them. GSL’s tend to establish separate board committees to provide sufficient attention to sustainability matters and to bring the key issues to the full board. Initial role of the sustainability committee is to establish the system, in time – as sustainability becomes part of doing business, structure can change (specialized issues to follow investments and innovation).

- 3Cascade sustainability responsibility across the organization: A top-down approach to sustainability and good governance is not effective unless it is supported by a bottom-up approach that rallies around ESG initiatives, consistently implemented across functions, divisions and business lines. (Ex: Newmont)

- 4Focus on risks and opportunities: The boards also need to provide sufficient oversight to the management’s identification of risks and opportunities of sustainability issues, including those related to strategy, regulatory and legal liability, product development and pricing, disclosure and reputation, as well as the management’s action plans. In doing so, the boards’ unfettered access to outside experts should be assured.

- 5Information quality determines decision quality: The board should be presented information not just on financials, but also information about the level of intellectual capital and reputation of the corporation, and supplier, customer, employee, and community satisfaction surveys are also required for quality decision making. Generally, these types of information may have greater relevance for the future value of the corporation and for the board members to fulfill their stewardship roles. Information flow to the board needs to be relevant, context-based, timely, balanced, and comprehensive.

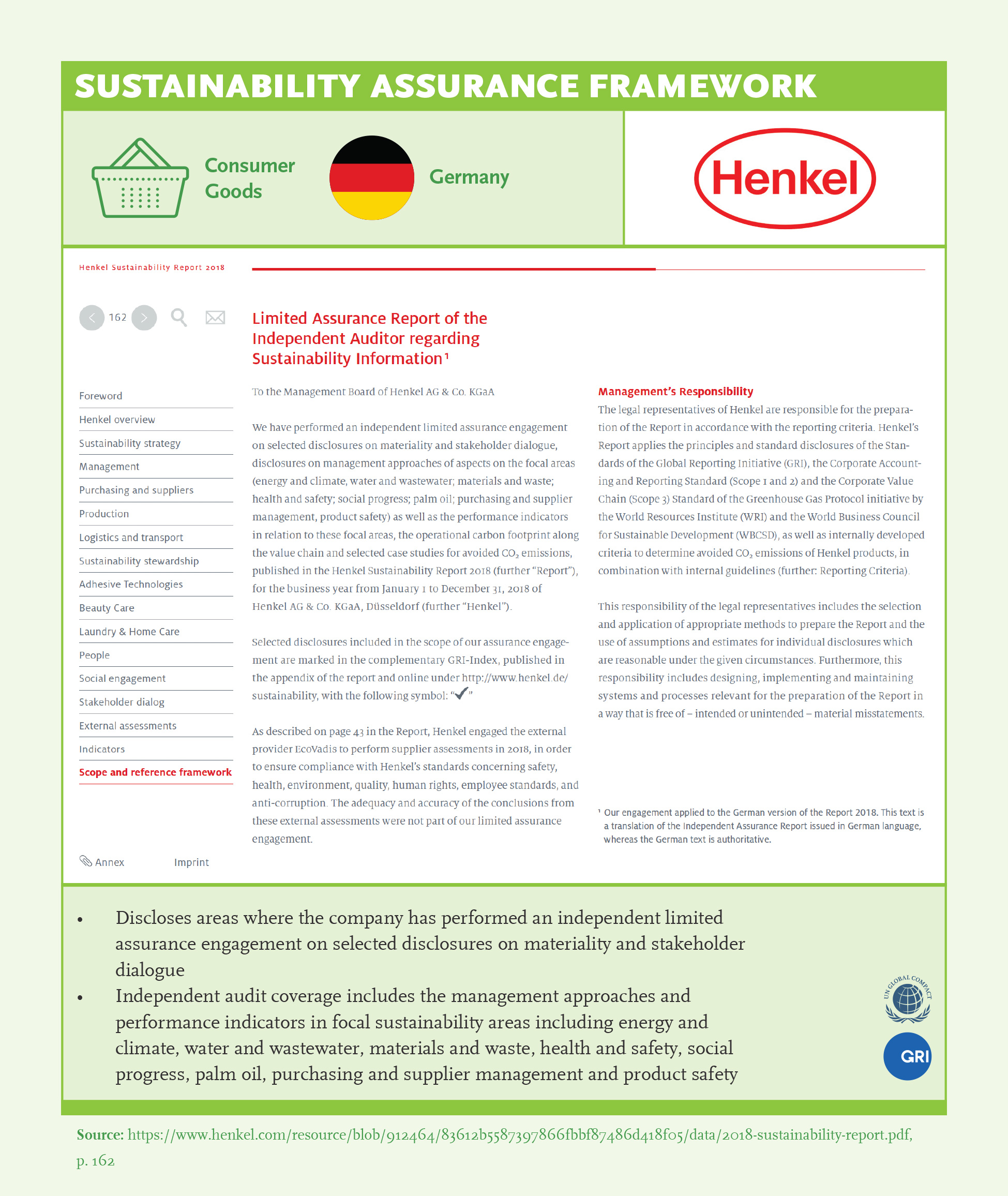

- 6Ensure internal and independent audit covers all material ESG issues, supply chain, and geographies: In order to exercise their oversight responsibilities, the boards should receive findings and recommendations from any investigation or audit by internal audit department, external auditors, regulatory agencies, corporation’s insurance companies, or third-party consultants concerning the corporation’s sustainability matters on a timely basis. Internal audit should focus to both financial and process related issues to improve implementation and play an advisory role. Internal audit function must have direct access to the board. Audit Committee charter should cover compliance and sustainability related issues. In order to provide effective oversight over sustainability issues; the Board must ensure that independent third-party reviews cover environmental, social, and governance issues. (Ex: Henkel)

- 7Conduct board evaluation, integrate ESG issues into board evaluation and disclose results: The board deliberations should also include evaluation of the adequacy of the D&O insurance package to sufficiently protect the directors against liabilities arising from sustainability issues. Boards should institute a learning and continuous improvement process for their own operations by incorporating the recommendations of the insurers into its sustainability plans and by conducting a regular self-evaluation exercise that evaluate the board’s approach and effectiveness in providing guidance and oversight on sustainability issues. Many companies utilize independent third-party experts to help conduct a comprehensive and objective self-evaluation process.

Key Findings

Board Oversight Responsibilities

The Board is responsible for providing oversight on sustainability issues, review and decide on the risk appetite and monitor implementation throughout the organization. The board’s oversight role requires setting up an effective internal control mechanism, ensuring independence of audit and strict compliance, monitoring ethics and business conduct within the company and its value chain, and transparency in external reporting and disclosure. Effective tracking of sustainability performance and communication to the board is essential for improving oversight of sustainability.

- Board Oversight responsibilities cover risk management, business strategy, executive compensation, and regulatory compliance for over 90%.

- Room for improvement in setting materiality thresholds, a critical step for developing an effective approach to sustainability, and political donations.

Board Charter

To provide oversight over material sustainability issues, boards should clearly define their sustainability responsibilities through a ‘Sustainability Charter.’ The Charter should clearly specify the scope of the board’s oversight of sustainability issues; specifically reference the company’s priority sustainability issues; make the linkages with the business strategies and priorities; and provide a framework for the integration with the company’s risk management systems. The board charter can cover the following areas:

- More attention must be paid to independent advice and training orientation, as well as to board evaluation and succession planning to ensure continuity of the board.

- Almost all the companies disclose role of the board in Board Charter covers strategy, internal control, audit, and risk management.

- >90% cover Ethics and Sustainability (Leaders in sustainability). All Consumer Goods companies Board cover Ethics and Sustainability issues. Almost all the companies in South Africa, boards role covers ethics and sustainability. Lowest coverage in China and Türkiye.

Board Committees

ESG review should be a Board priority and boards need to allocate sufficient time and resources to deal with the sustainability risks and management plans to address them. Global Sustainability Leaders tend to establish separate board committees to provide sufficient attention to sustainability matters and to bring the key issues to the full board. Initial role of sustainability committee is to establish the system, in time – as sustainability becomes part of doing business, structure can change (specialized issues to follow investments and innovation).

- All companies have an audit committee with a charter and independent chair, and almost all companies have a remuneration committee.

- There is room for improvement in risk, sustainability, and governance committees – to create the forum in which sustainability and governance opportunities and risks can be addressed.

Independent Audit and Access to Information

Independent audit of ESG performance and processes are also important for transparency purposes. One reason external assurance for sustainability issues is not widespread is because sustainability reporting covers diverse topics and quantitative as well as qualitative metrics that are difficult to measure. Furthermore, the material sustainability issues vary by sector and even by company. Consistent external assurance and disclosure for sustainability issues can enable the development of standards in sustainability reporting and provide investors with increased confidence in the quality of sustainability performance data, thereby making it useful for decision-making.

- Independent audit covers financial issues for all companies in our sample.

- Independent audit coverage of non-financial issues increased to 84% in SGS 2020 from 72% in SGS 2019.

- Independent audit coverage is 76% for environmental issues, while 70% for social issues and 61% for governance issues.

- Independent audit coverage for supply chain is 54%.

Best Practice Examples